Does Venmo Report to IRS in 2025? Everything You Need to Know

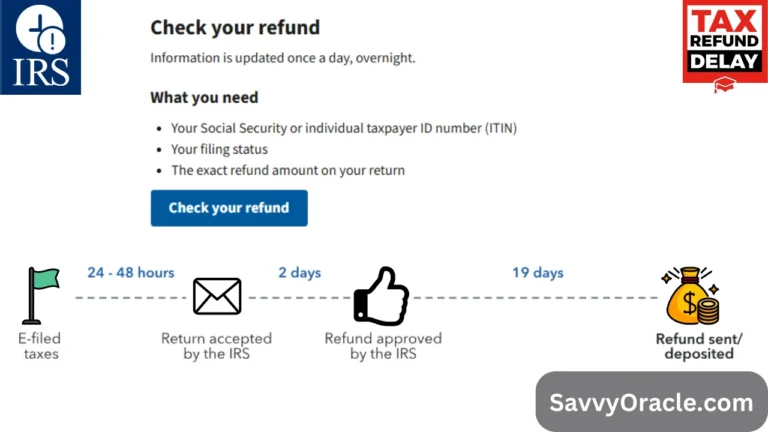

For sending and receiving money effortlessly, Venmo has become a widely used peer-to-peer payment platform. As tax regulations evolve, many users wonder: Does Venmo report transactions to the IRS in 2025? Yes, but the extent depends on the type of transaction and the amount involved.

Venmo and IRS Reporting Requirements in 2025

Venmo must comply with IRS regulations regarding third-party payment processors starting in 2025. According to the American Rescue Plan Act of 2021, the $600 tax threshold determines whether Venmo reports your transactions.

Key IRS Reporting Rules for Venmo Users

- $600 Threshold for Business Transactions

Venmo must file Form 1099-K with the IRS if you receive more than $600 in payments for goods or services through Venmo during a calendar year. - Personal Transactions Are Not Reported

For personal transactions, such as sending money to friends and family, Venmo is not taxable and is not reported to the IRS. However, if the money is used to purchase goods or services, it must be reported as a taxable transaction. In addition, Venmo fees must also be reported. - Self-Employed & Gig Workers

It is still necessary for freelancers, independent contractors, and small business owners to report their income on Venmo even if they do not receive a 1099-K.

Check Also: How Far Back Can the IRS Audit You? Understanding the Statute of Limitations

What Information Does Venmo Report to the IRS?

Venmo will provide the IRS with the following information if your transactions meet the reporting criteria:

- Total gross payments for goods and services received

- Social Security Number (SSN) or Taxpayer Identification Number (TIN)

- Name of your business (if applicable)

- Contact information and address

Check Also: Does Zelle Report to the IRS? Understanding the Tax Implications

Avoiding Tax Issues with Venmo in 2025

In order to avoid penalties and ensure compliance:

- Maintain accurate records of all payments

- Use a Venmo Business Profile to separate business and personal transactions

- Even if you do not receive a 1099-K, report all taxable income

- If you are unsure about your tax obligations, consult a tax professional

Check Also: How Coinbase Reports to the IRS: Updated Tax Rules for 2025

Common Misconceptions About Venmo and Taxes

- “Venmo transactions under $600 are tax-free.”

False. Venmo does not report transactions under $600, but you are still legally required to report any taxable income. - “I can avoid taxes by splitting payments.”

False. IRS penalties may apply if you split payments into smaller amounts to stay under the $600 threshold. - “Only business accounts get reported.”

False. Even on a personal Venmo account, payments marked as “goods and services” may require reporting.

Check Also: What Amount Does Cash App Report to IRS?

Conclusion: What Venmo Users Should Do in 2025

Venmo reporting must be understood as IRS tax laws tighten. Stay up-to-date on IRS regulations and keep detailed financial records if you use Venmo for your business or side hustle.

Would you like further guidance? To ensure full compliance with IRS requirements in 2025, consult a tax expert.