How Long Does It Take for IRS to Approve Refund After It Is Accepted?

Throughout the year, taxpayers eagerly await their tax refunds, and understanding the IRS approval process is essential. We’ll examine how long it typically takes for the IRS to approve a refund after accepting your tax return, how factors can affect this timeline, and how to expedite the process.

Understanding the IRS Refund Process

Once you file your tax return, the IRS follows a systematic process to review, approve, and disburse your refund. There are three main steps to follow:

- Return Submission: You can submit your return electronically or by mail to the IRS.

- Return Acceptance: Your return is validated by the IRS to ensure accuracy and compliance.

- Refund Approval: The IRS processes your refund for disbursement once it has been accepted.

Typical Timeline for Refund Approval

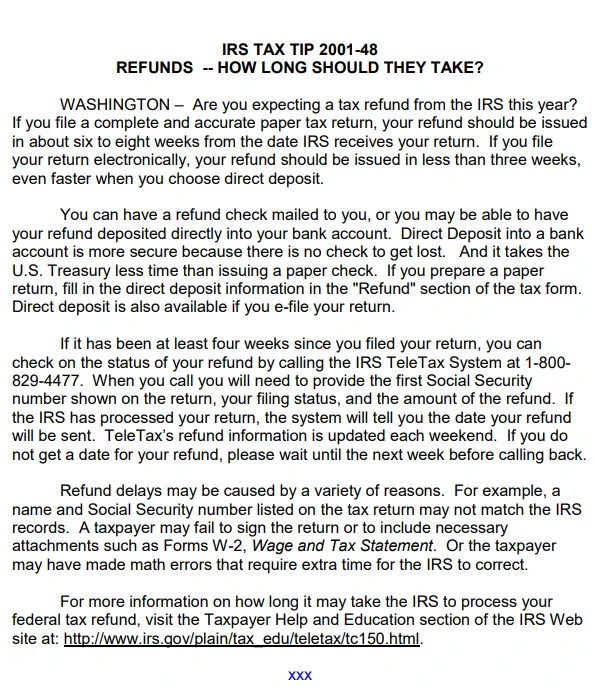

Several factors can affect how quickly the IRS approves your refund, including how your return was filed and whether errors were found. The breakdown is as follows:

- The approval of e-filed returns usually takes between 24 and 48 hours after acceptance. In most cases, refunds are issued within 21 days.

- In the case of paper returns, approval can take up to four weeks due to manual processing. It may take 6-8 weeks for a refund to be processed after it has been accepted.

| Filing method | E-file/Direct deposit | Paper file/Direct deposit | E-file/Check | Paper file/Check |

| Refund time | 1-3 weeks | 3 weeks | 1 month | 2 months |

Factors That May Delay Approval

The IRS refund approval process can be slowed down by several factors:

- Errors or Missing Information: Common mistakes like incorrect Social Security numbers or mismatched income details.

- Review for Credits: Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) claims often require extra attention.

- Fraud Prevention Measures: Additional checks are performed on returns flagged as potentially fraudulent.

- High Filing Season Volume: Tax submissions may be delayed during peak tax season.

Also Check: How Long Can the IRS Keep Your Refund Under Review?

How to Check the Status of Your Refund

You can track your refund status using the IRS’s tools. Among them are:

- IRS “Where’s My Refund?” Tool: You can access this tool on the IRS website to check the status of your refund.

- IRS2Go Mobile App: Track your refund conveniently on your smartphone.

To use these tools, you’ll need:

- Social Security number or ITIN

- Filing status

- Exact refund amount

Tips to Expedite Your Refund

Follow these best practices to ensure a faster refund approval process:

- File Electronically: E-filing minimizes errors and accelerates processing.

- Choose Direct Deposit: Opt for direct deposit to receive funds more quickly than a mailed check.

- Double-Check Information: Review your return for accuracy before submitting.

- File Early: Avoid the peak tax season rush by submitting your return early.

FAQs About IRS Refunds

1. Can the IRS take more than 21 days to approve a refund?

The timeline can be extended by certain factors, such as errors or credit reviews.

2. If my refund is delayed, what should I do?

Use the IRS tools mentioned above to check your status. Updates can be obtained from the IRS if necessary.

3. How long does it take for my refund to be processed after I amend my return?

In most cases, amending a return takes up to 16 weeks.

Conclusion

After your refund has been accepted, the IRS takes a certain amount of time to approve it, depending on the filing method, accuracy, and the season. Refunds for e-filed returns are usually issued within 21 days, but delays can occur. You can speed up the process by filing early, avoiding errors, and using direct deposit.

Ensure a smooth tax season by staying informed and planning ahead.