When Does IRS Stop Accepting E-File? Key Deadlines & Important Details

To file taxes on time, you must understand when the IRS shuts down e-file. To prepare for the upcoming tax season, the IRS typically ceases accepting electronically filed tax returns in November. Keeping track of these key dates helps taxpayers avoid late filing penalties and stay in compliance with federal tax laws.

IRS E-File Start and Stop Dates

An IRS shutdown and start date for e-filing is announced every year. The following table summarizes past and upcoming e-filing dates:

| Tax Year | E-File Start Date | E-File Stop Date |

|---|---|---|

| 2020 | January 27, 2021 | November 20, 2021 |

| 2021 | January 24, 2022 | November 26, 2022 |

| 2022 | January 23, 2023 | November 18, 2023 |

| 2023 | January 29, 2024 | November 30, 2024* |

| 2024 | Expected Late January 2025* | Expected November 2025* |

For the most up-to-date schedule, visit the IRS Modernized e-File (MeF) Status Page.

Why Does the IRS Close E-Filing in November?

During the annual e-file shutdown, the IRS is able to:

- Perform System Maintenance: Prepare for the new tax year by upgrading tax processing systems.

- Implement Tax Law Updates: Update tax policies, credits, and deductions.

- Update Tax Forms: Make sure all IRS forms and instructions are current.

IRS systems will be able to process tax returns efficiently during this maintenance period.

Key IRS Tax Deadlines

Keep these IRS deadlines in mind to avoid last-minute issues:

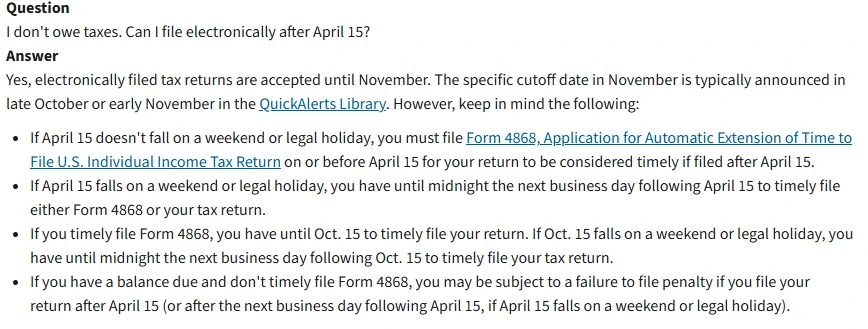

- April 15: Individual tax returns (Form 1040) must be filed by this date. During weekends and legal holidays, April 15 is extended to the next business day.

- October 15: Extended deadline for individual tax returns (Form 4868) filed by April 15.

- November (the Exact Date is Announced Annually): The IRS stops accepting e-filed returns in preparation for the upcoming tax season.

The IRS began accepting tax returns on January 29, 2024, and the filing deadline was April 15, 2024.

Check Also: What is the IRS Mileage Rate? Standard Mileage Deductions Explained

What Happens If You Miss the E-File Deadline?

There are two options if you miss the IRS e-file closure date:

- File a Paper Return: The IRS accepts paper tax returns by mail. Make sure it’s postmarked by the due date to avoid penalties.

- Wait Until E-Filing Reopens: In late January, the IRS usually reopens e-filing. You can wait until e-filing resumes if your return is not urgent.

If you owe taxes, delaying your filing may result in penalties. To minimize interest and penalties, file as soon as possible.

Check Also: When Does IRS Free File Open? a Guide

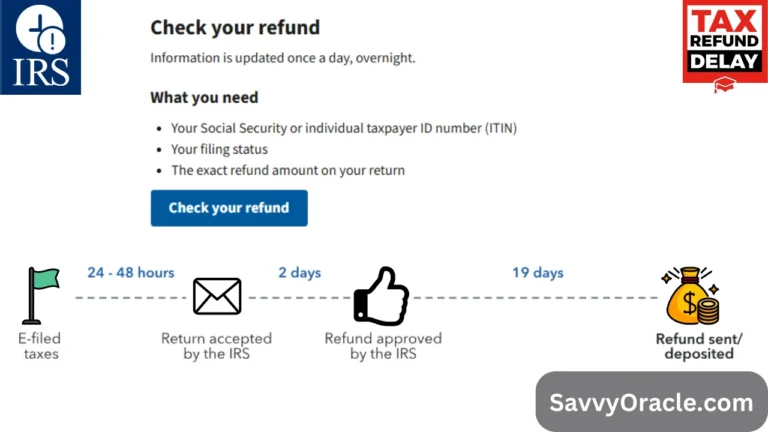

How to Check the IRS E-File Deadline

Keep up with the IRS e-file shutdown schedule by following these steps:

- Official IRS Website: Visit the IRS Modernized e-File (MeF) Status Page for the latest information.

- IRS QuickAlerts: Receive timely notifications about e-file events by signing up for IRS QuickAlerts.

- Tax Software Providers: Tax software platforms such as TurboTax, H&R Block, and TaxAct often inform users about IRS deadlines and system statuses.

Check Also: Can IRS Debt Be Discharged in Chapter 7 of Bankruptcy?

Conclusion

Keeping track of when the IRS stops accepting e-filed tax returns is essential for timely and accurate tax filing. Typically, the IRS shuts down e-filing in November for system maintenance. Make sure you file your tax returns before the shutdown or be prepared to file by paper or wait until e-filing resumes. Check the IRS website regularly and consult a tax professional if necessary for the most current information.