Where’s My Amended Return? IRS.gov Status Check Guide

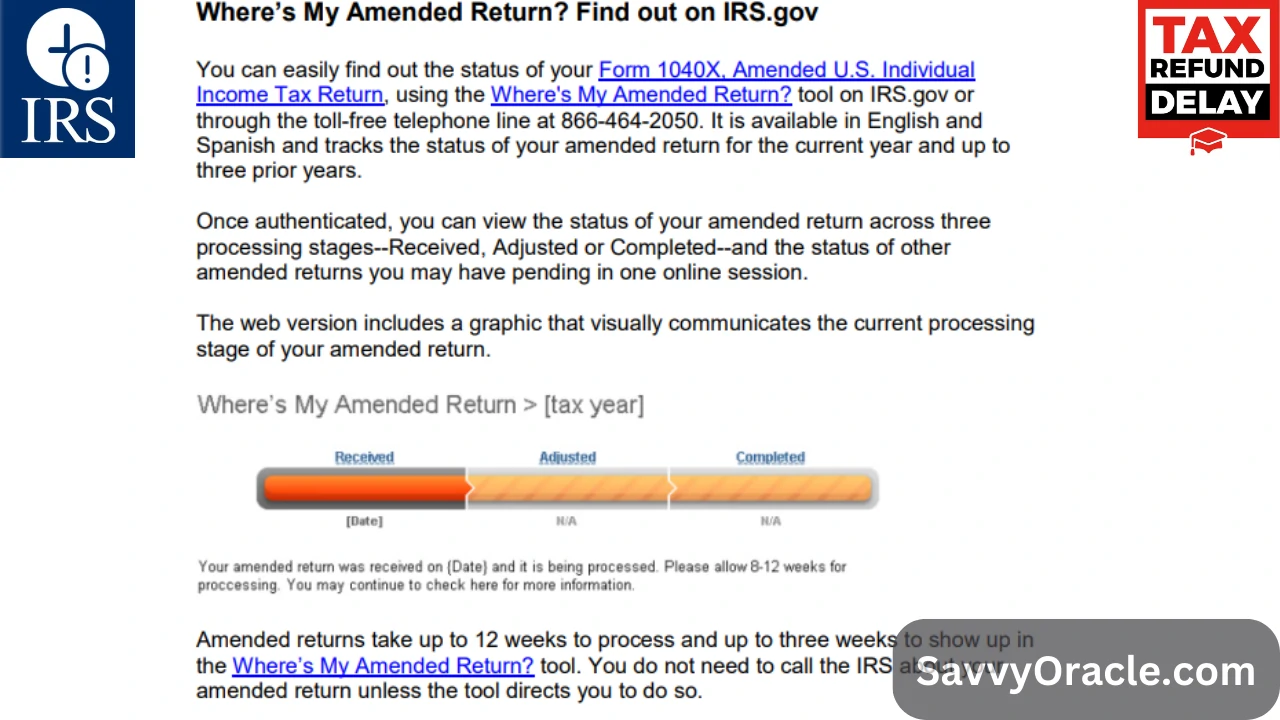

Those who need to amend their U.S. individual income tax returns can conveniently track the status of their amended returns with the “Where’s My Amended Return?” tool, available on IRS.gov. This easy-to-use tool allows individuals to monitor their amended return status for the current year and up to three prior years.

What You Need to Access the Tool

You will need the following information to check the status of your amended return:

- Social Security Number (or Taxpayer Identification Number)

- Date of Birth

- ZIP Code

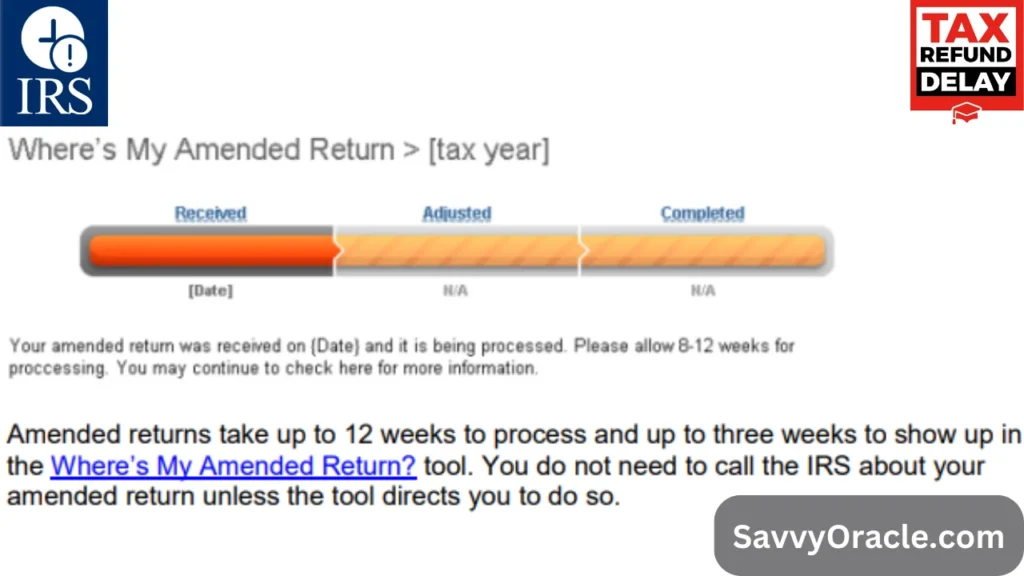

You will be able to see the progress of your return across three stages once you have been authenticated:

- Received – Your amended return has been received by the IRS.

- Adjusted – Your return has been modified.

- Completed – We have processed your amended return.

Check Also: Does Zelle Report to the IRS? Understanding the Tax Implications

Processing Timeframes

Amended returns are usually processed in 8-12 weeks, but in some cases, they may take up to 16 weeks. After you submit your return, it may take up to three weeks for it to appear in the system.

Tool Availability

The “Where’s My Amended Return?” tool is accessible 24/7, except during routine maintenance periods:

- Mondays: 12:00 AM – 3:00 AM (ET)

- Occasional Sundays: 1:00 AM – 7:00 AM (ET)

Returns That Cannot Be Checked

The following return types are not supported by the tool:

- Business tax returns

- Returns with foreign addresses

- Carryback applications or claims

- Injured spouse claims

- Specialized units (e.g., Examination and Bankruptcy teams) process returns

- Using Form 1040-X instead of Form 1040-Amended

Check Also: How Coinbase Reports to the IRS: Updated Tax Rules for 2025

When to Contact the IRS

If the tool directs you to call the IRS, you don’t need to do so. For assistance, you can contact the IRS’s automated Amended Return line at 866-464-2050.

Additional Resources

You can find more detailed information on these pages:

- Amended Return FAQs

- Tax Topic 308: Amended Returns

- Processing Status Dashboard

Check Also: How Can I Get My IP PIN from the IRS Online?

Key Takeaways

The IRS ensures transparency and convenience with the “Where’s My Amended Return?” tool, helping taxpayers monitor their returns seamlessly. You should prepare the required details and allow ample time for processing before contacting us.

For more information, visit IRS.gov today and take control of your amended return process!

Sources: